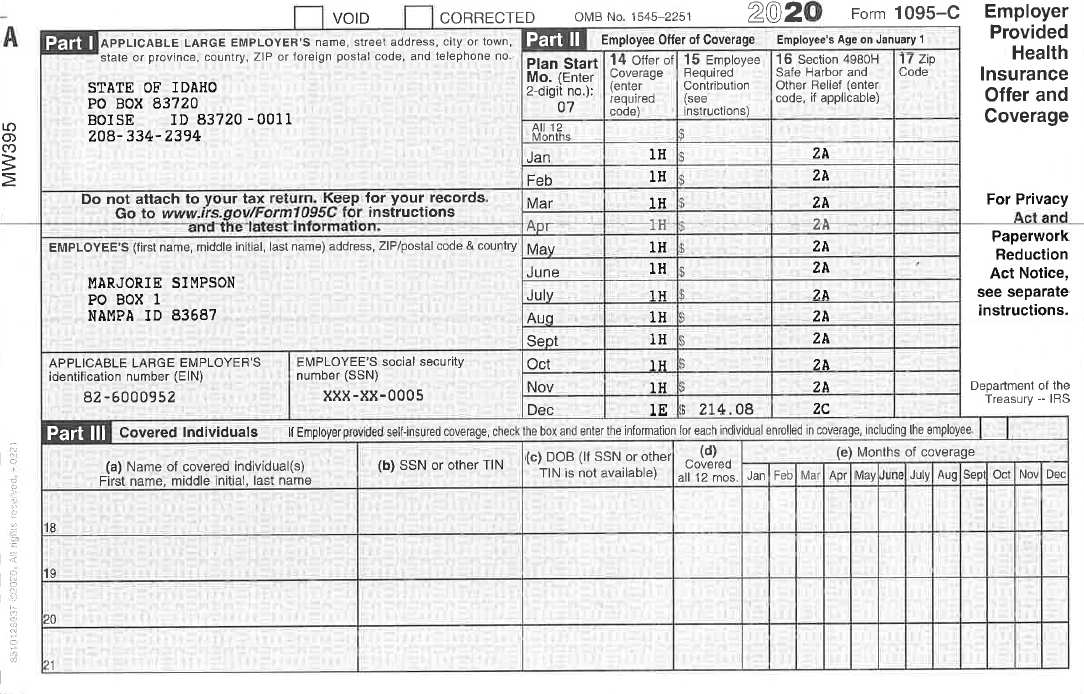

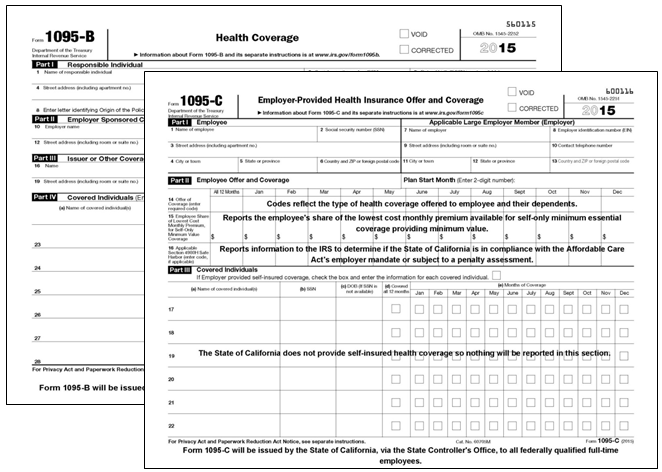

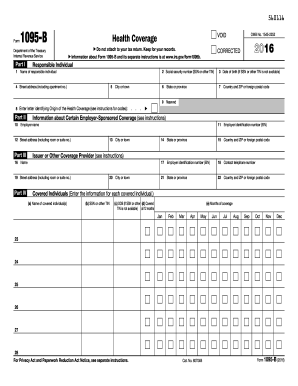

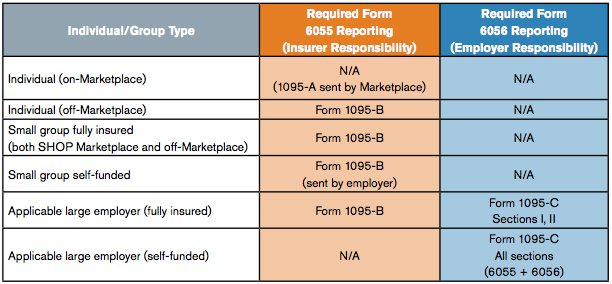

There are other IRS tax forms that are similar to Form 1095C that you may request IRS Form 1095B details the months of health insurance coverage that you, your spouse and/or any eligible dependents had for each month Form 1095B is generally provided by the insurance carrier and provides details about the health insurance coverage you elected, including who in your familyCODES FOR IRS FORM 1095C 2F Section 4980H affordability Form W2 safe harbor Enter code 2F if the employer used the section 4980H Form W2 safe harbor to determine affordability for purposes of section 4980H(b) for this employee for the year If an ALE Member uses this safe harbor for an employee, it must be used for all months of the calendar year for which theMembers of the MIIA Trust will complete Parts I and II of Form 1095C for every employee who was employed in fulltime status (ie averaging at least 30 hour per week) at any time during 16 Members of the Trust should not complete Part III of Form

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

What do the codes on form 1095 c mean

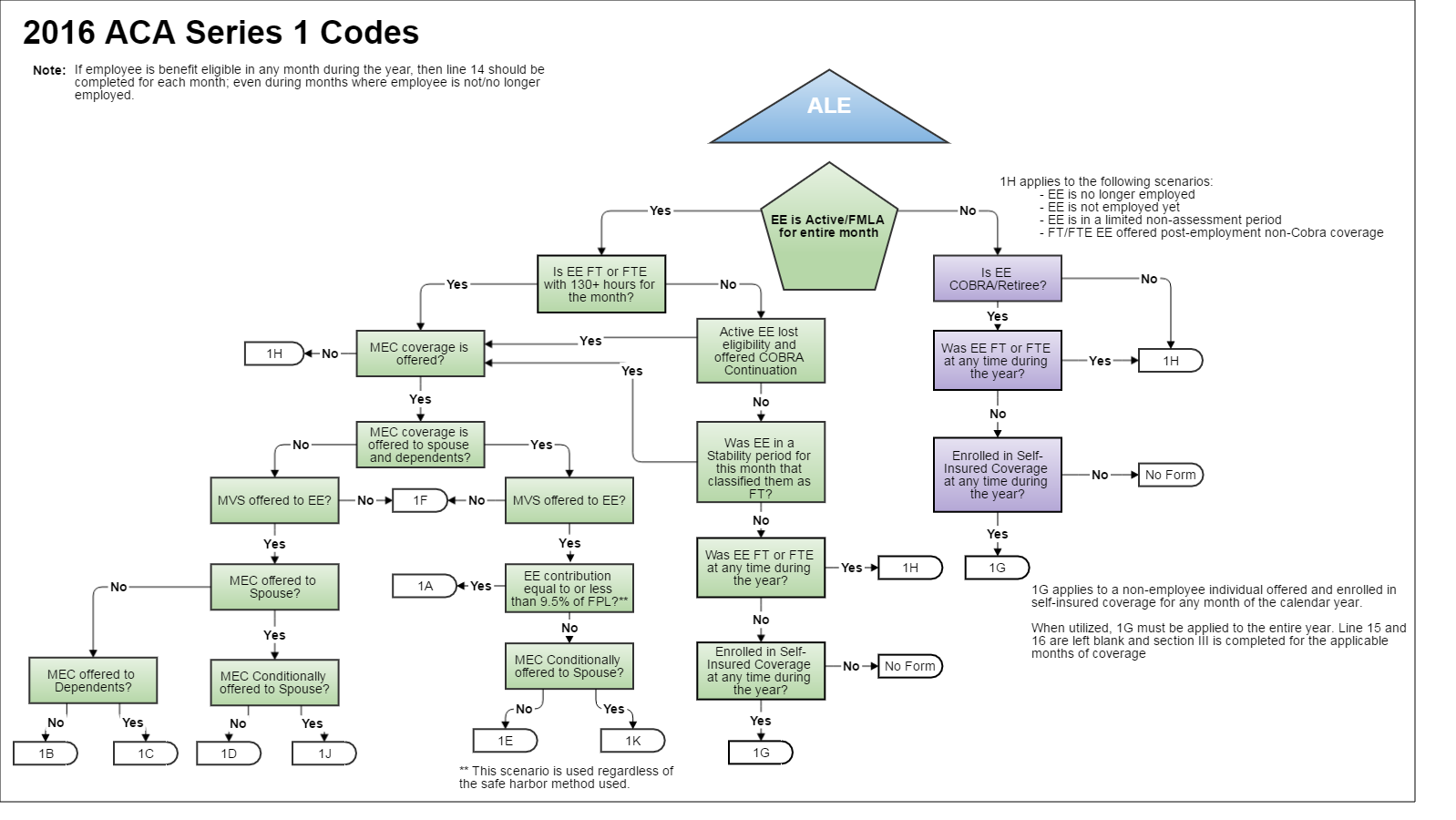

What do the codes on form 1095 c mean-Coverage information to the IRS to communicate and verify the minimum coverage requirement has been met In this eBook, you'll find a breakdown of Code Series 1 and Code Series 2, as well as an infographic that breaks down Form 1095C line by line Introduction Table of Contents 03 Code Series 1 – Line 14 05 Code Series 2 – Line 16Video instructions and help with filling out and completing 1095c codes 18 Instructions and Help about 1095c codes 18 Welcome to hub internationals 17 ACA reporting refresher we will focus primarily on the completion of form 1095 see how to complete lines 14 in line 16 as well as some examples that discuss the coordination of multiple codes as to complete those specific

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

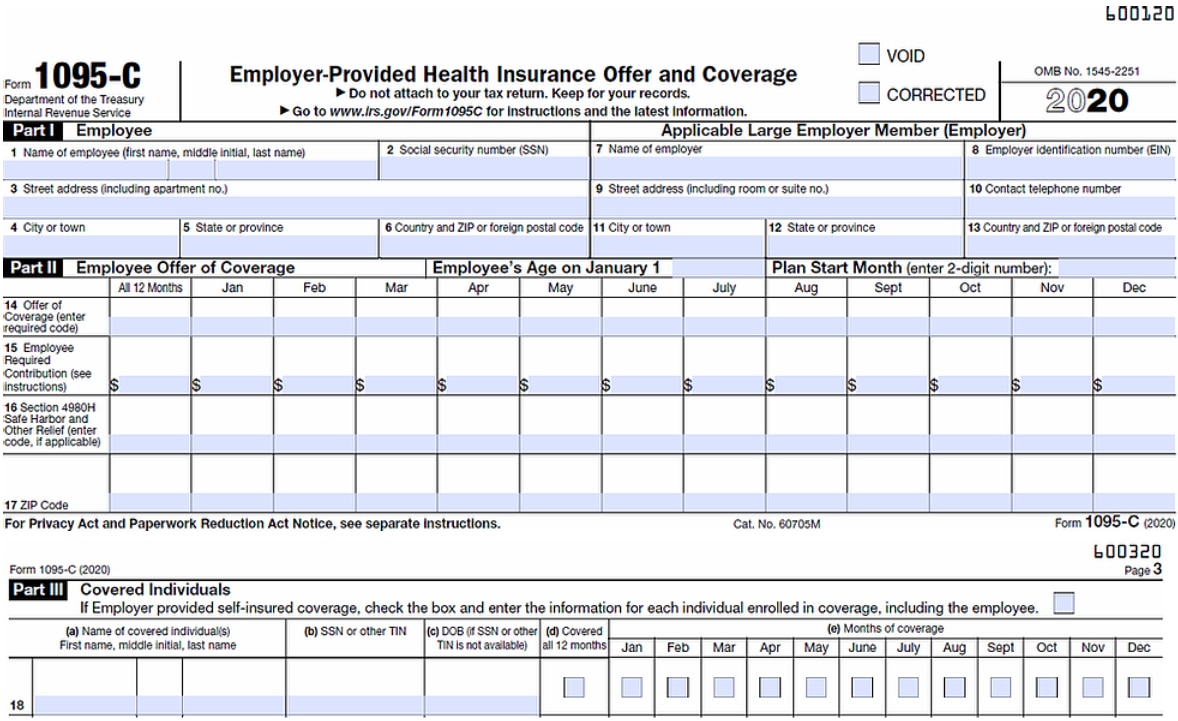

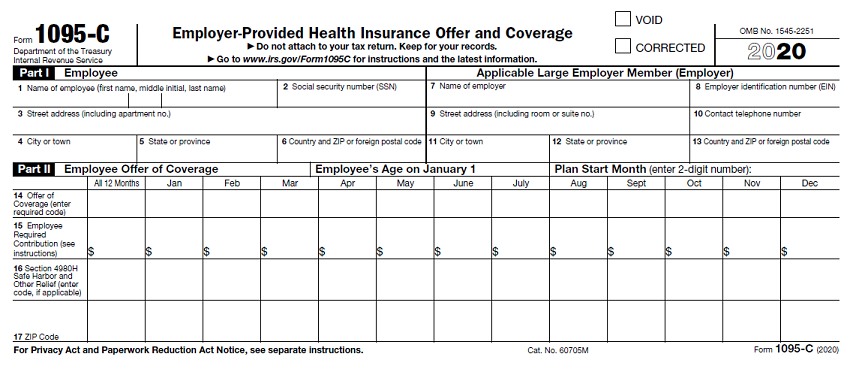

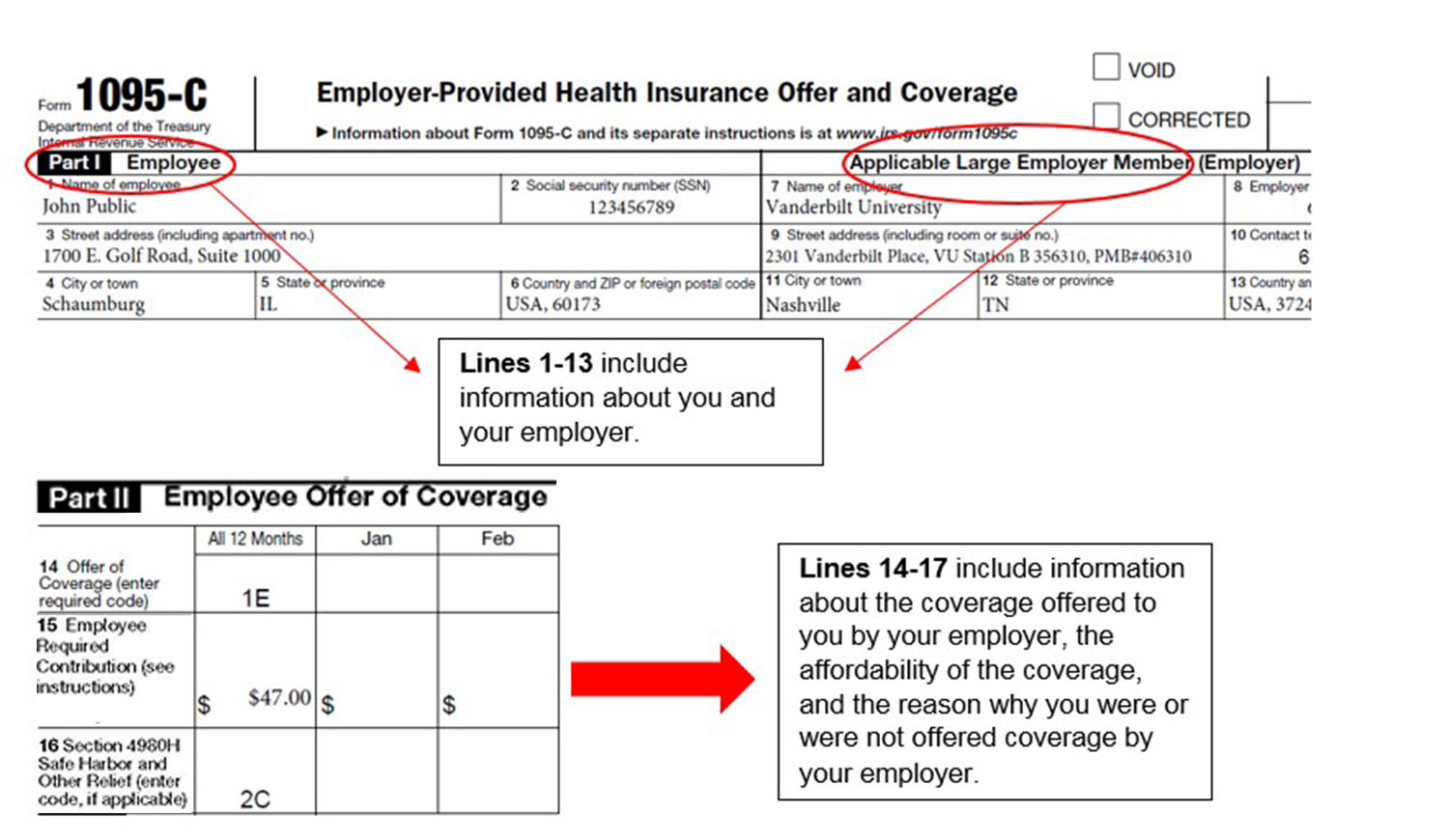

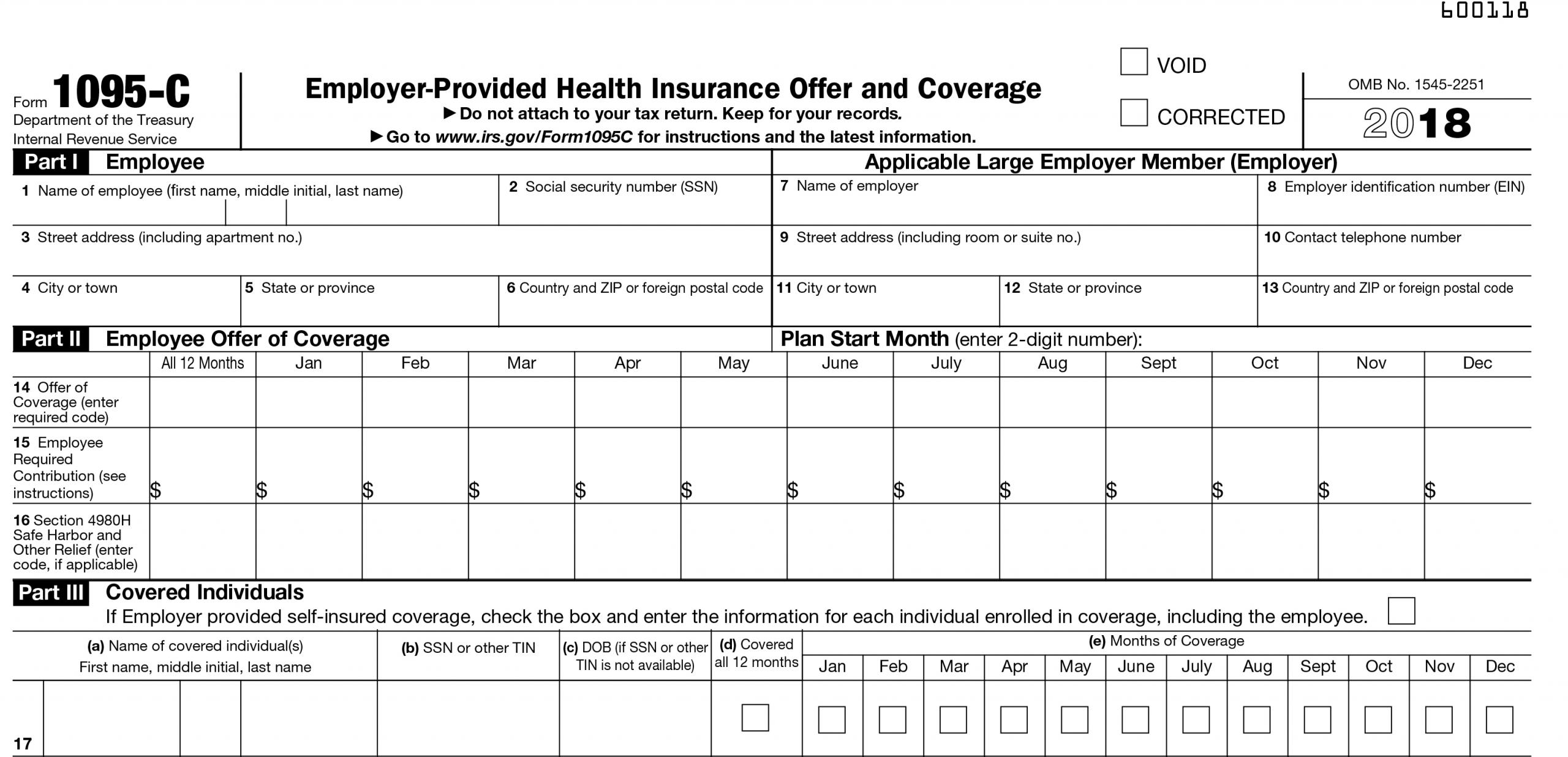

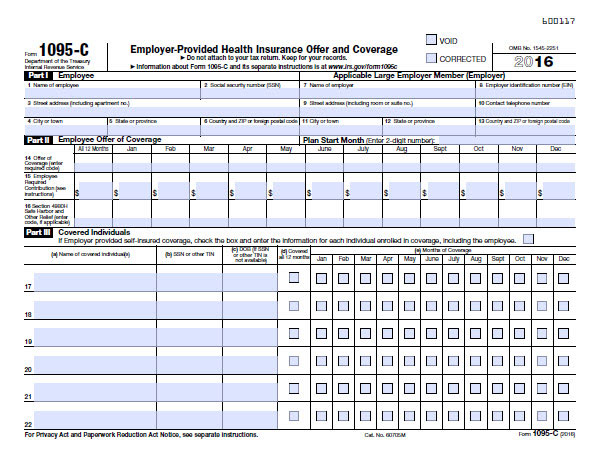

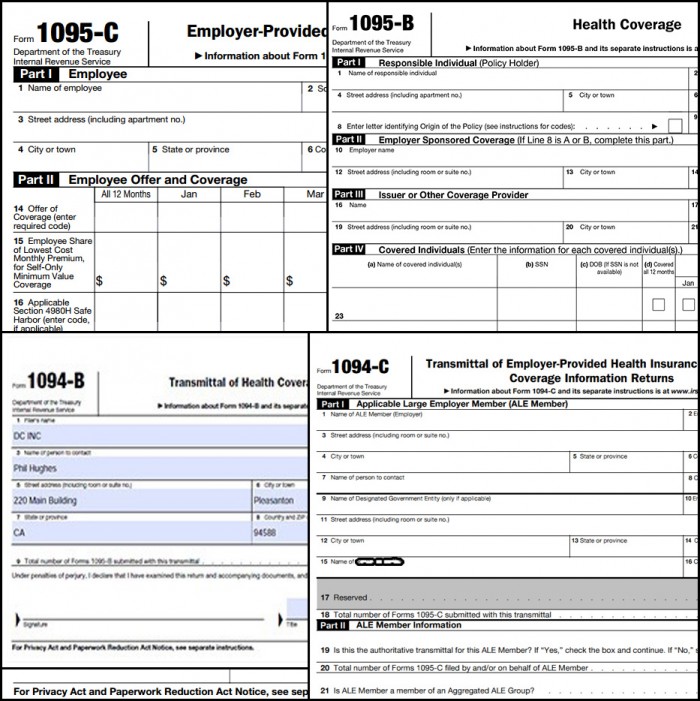

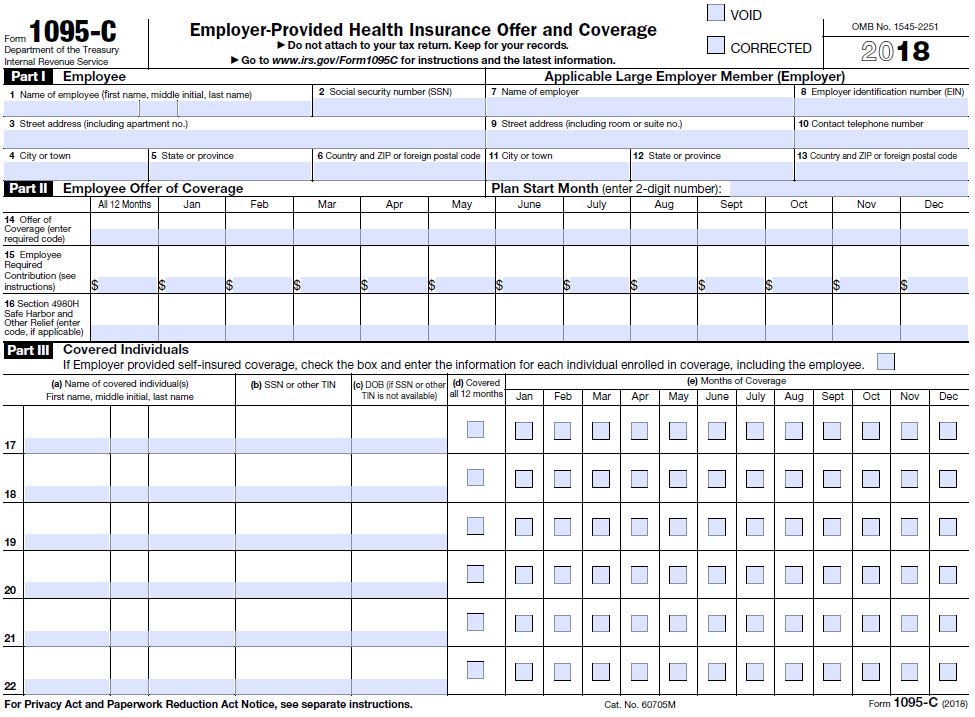

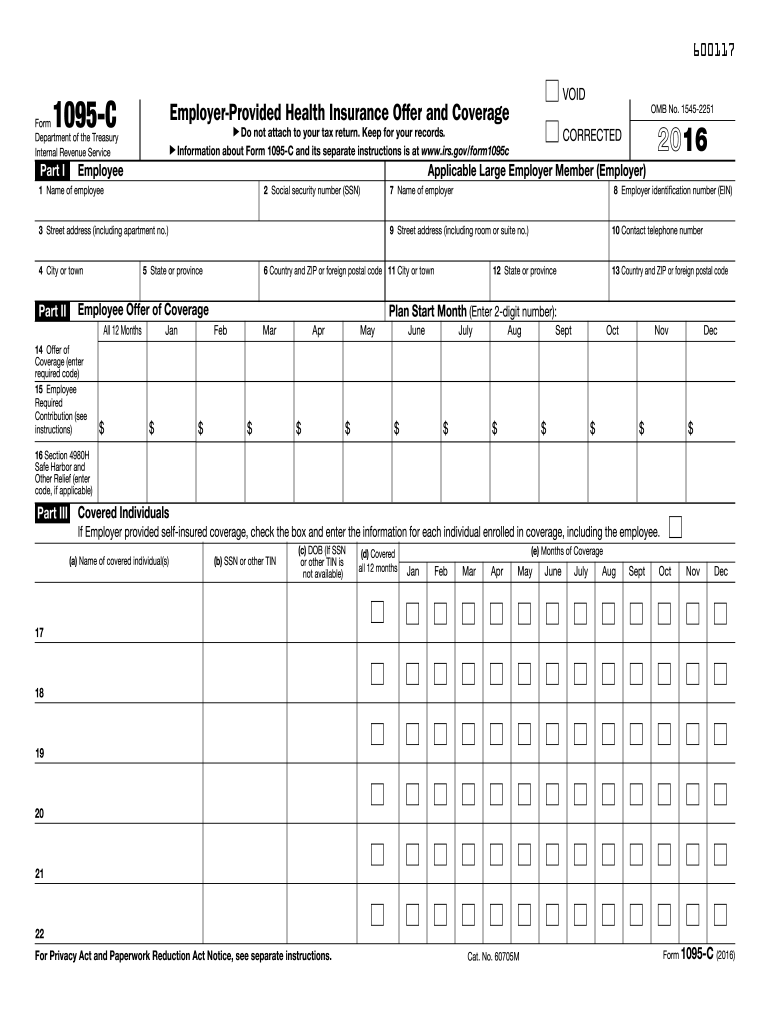

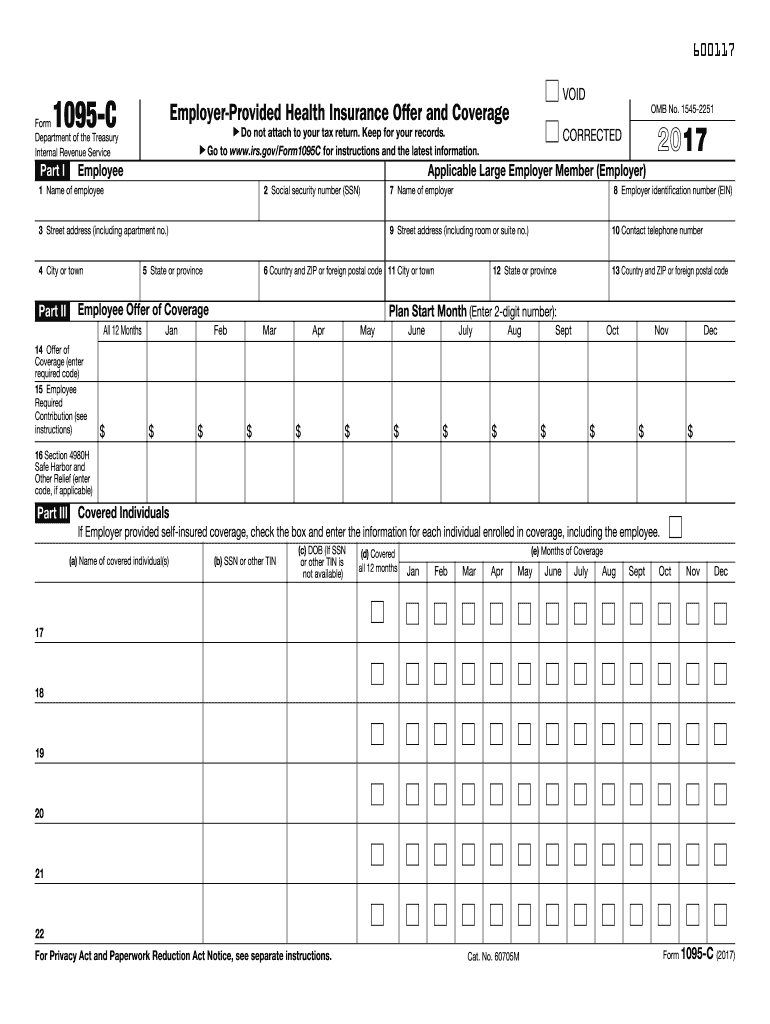

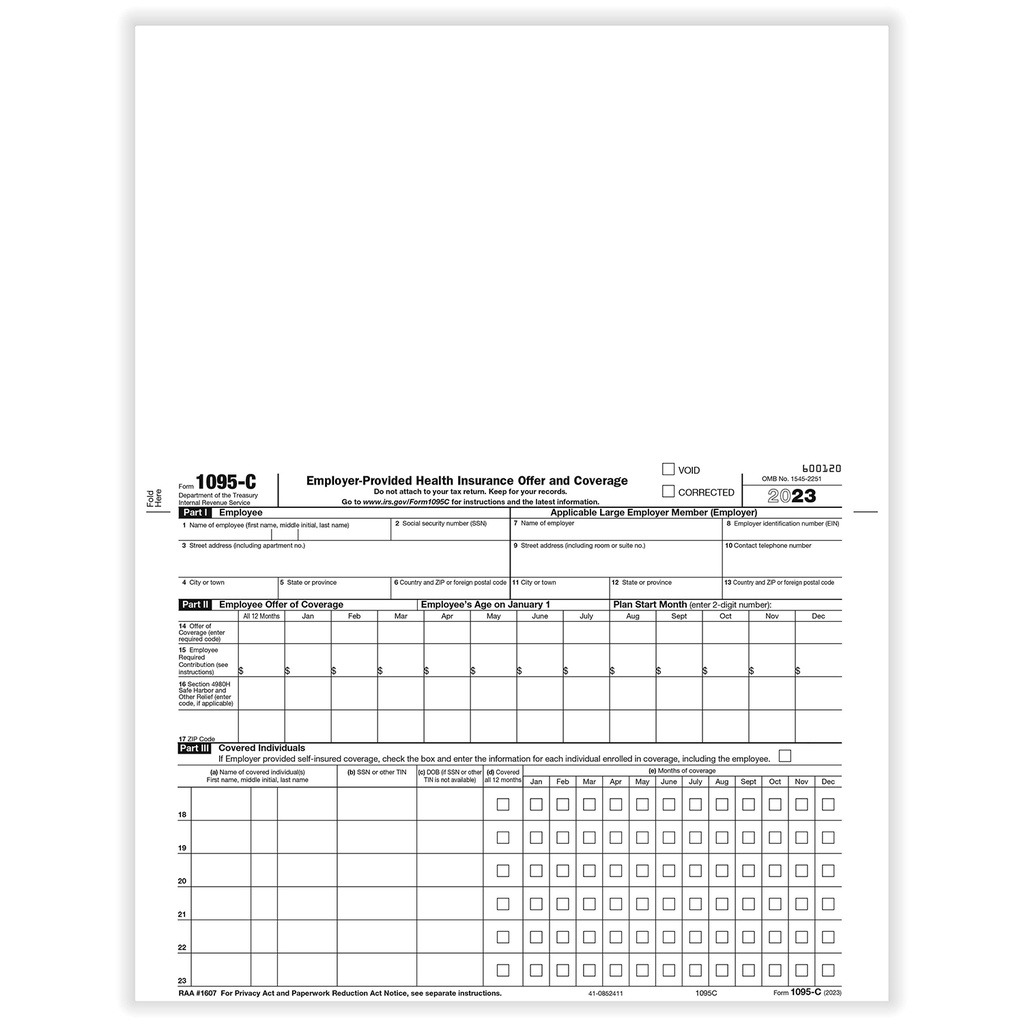

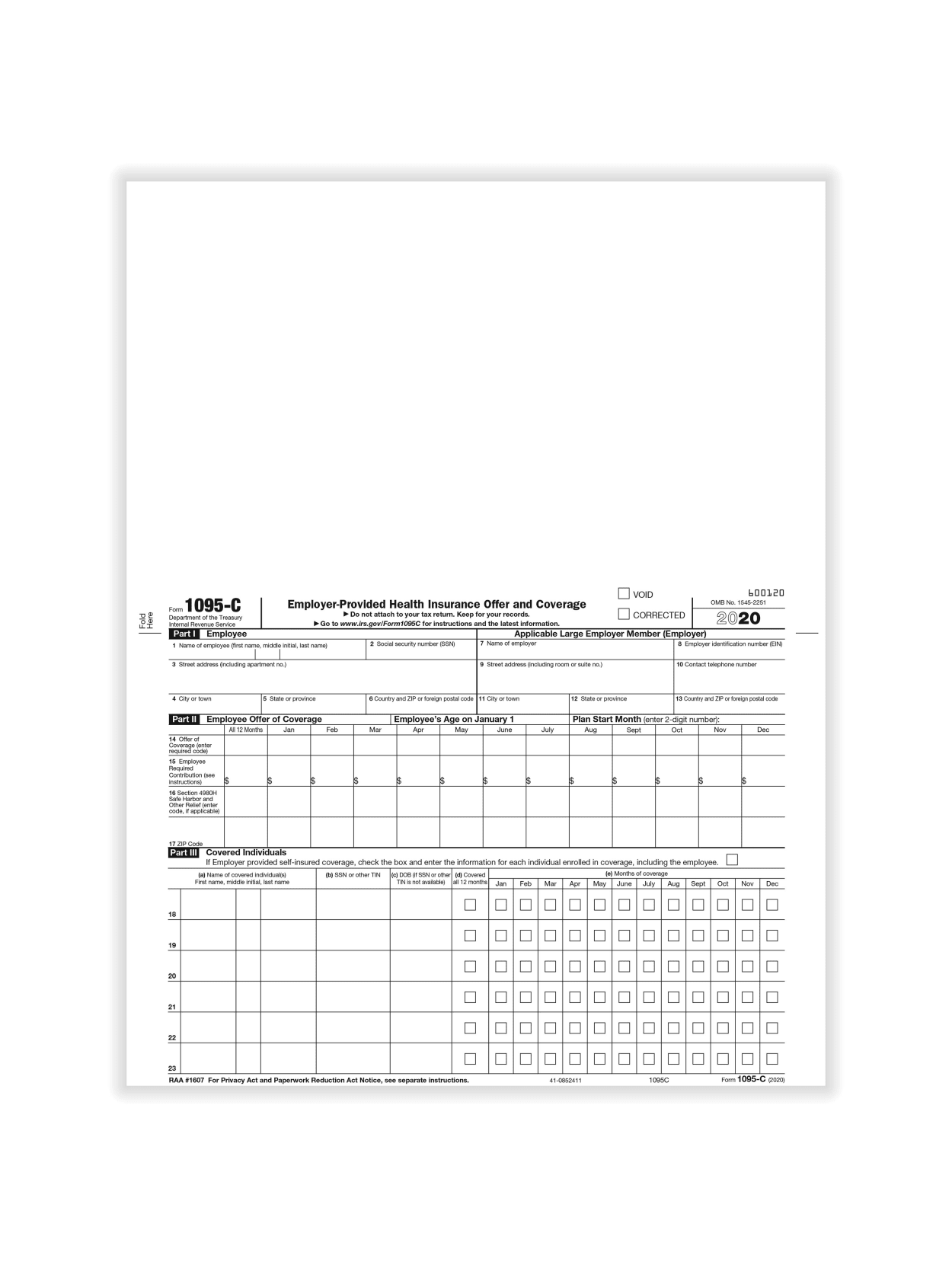

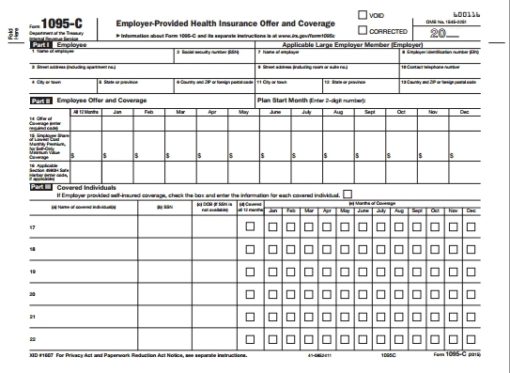

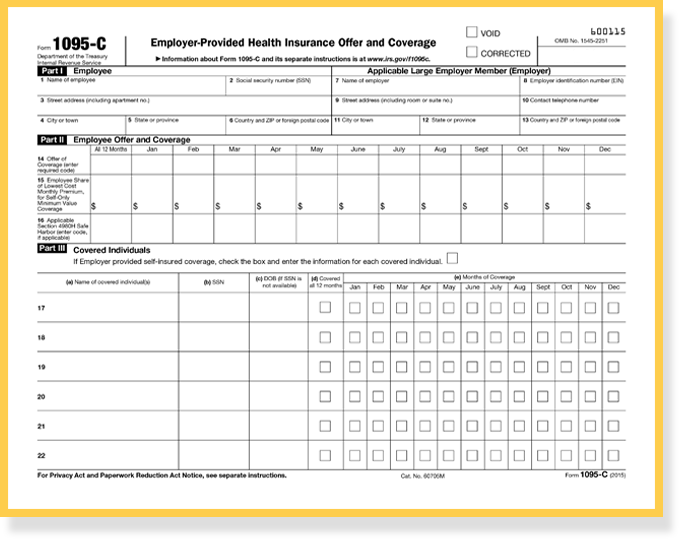

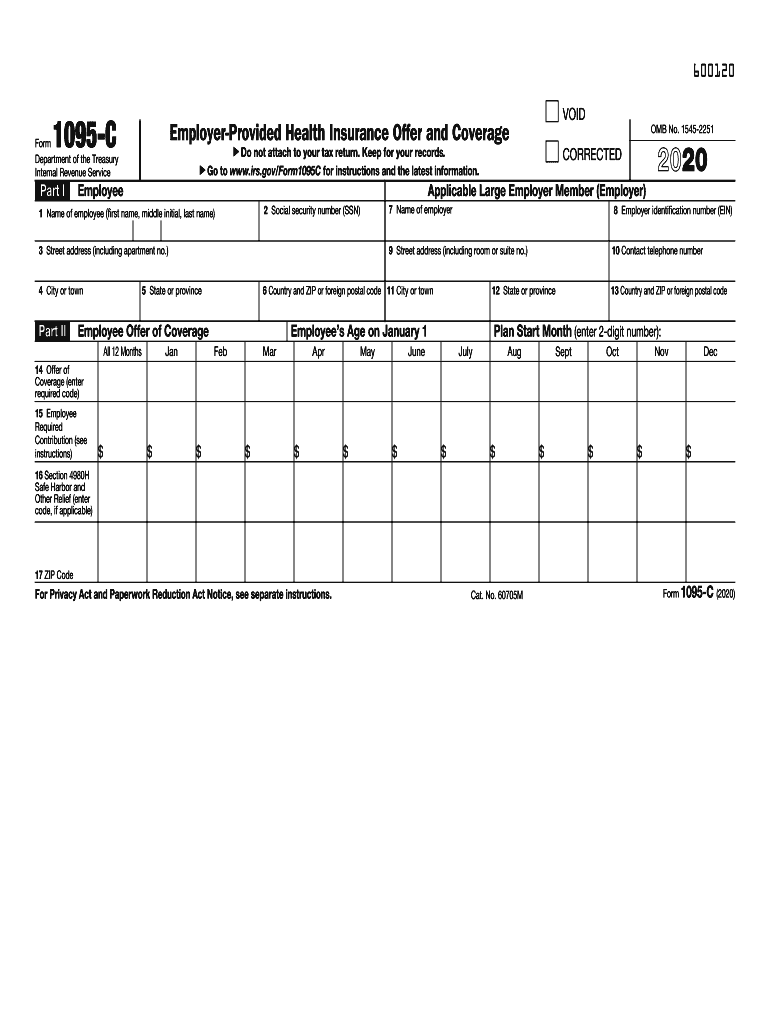

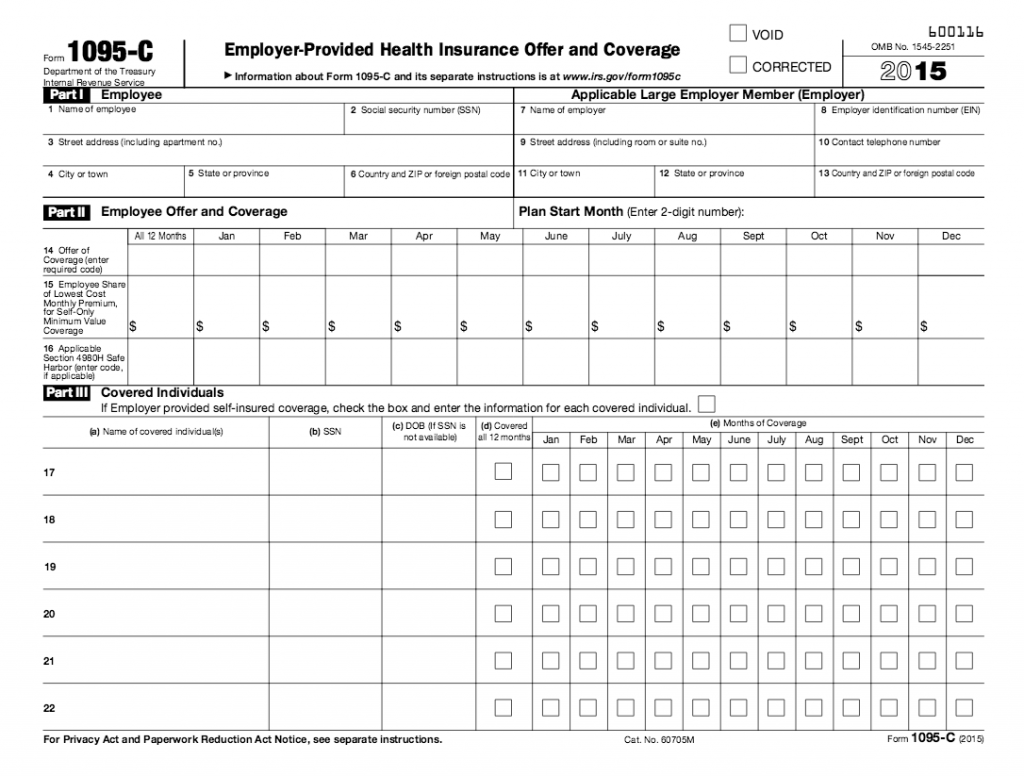

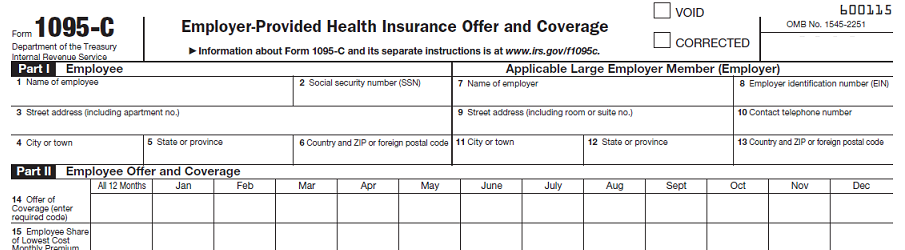

Calculating the 1095C Lines 1416 codes is one of the more daunting tasks of ACA reporting For 15 tax reporting, many employers found themselves relying on their "best guesses" to correctly determine and complete their 1095C Part II codes UnifyHR has created a Guide to provide an overview of IRS Form 1095C and the required Part II Codes to empower you with theForms 1095C and 1094C Form 1095C has two purposes 1 Establish the employer's compliance with the Employer Mandate 2 Provide information that will be used by the IRS in determining whether an individual is eligible for premium assistance when obtaining coverage through a Marketplace and will assist the IRS · To satisfy the reporting requirements effective this 16 taxfiling season, fully insured and selfinsured applicable large employers must complete Form 1095C (and the 1094C transmittal form) Similar to W2s and 109 9s, this involves distributing employee statements by one date, followed by filing with the IRS (either by paper or electronically) by a second date

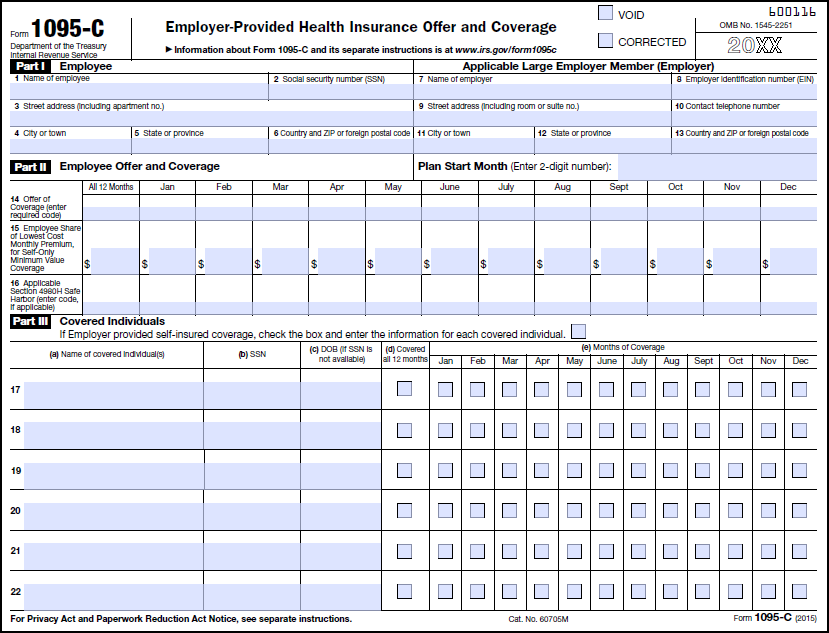

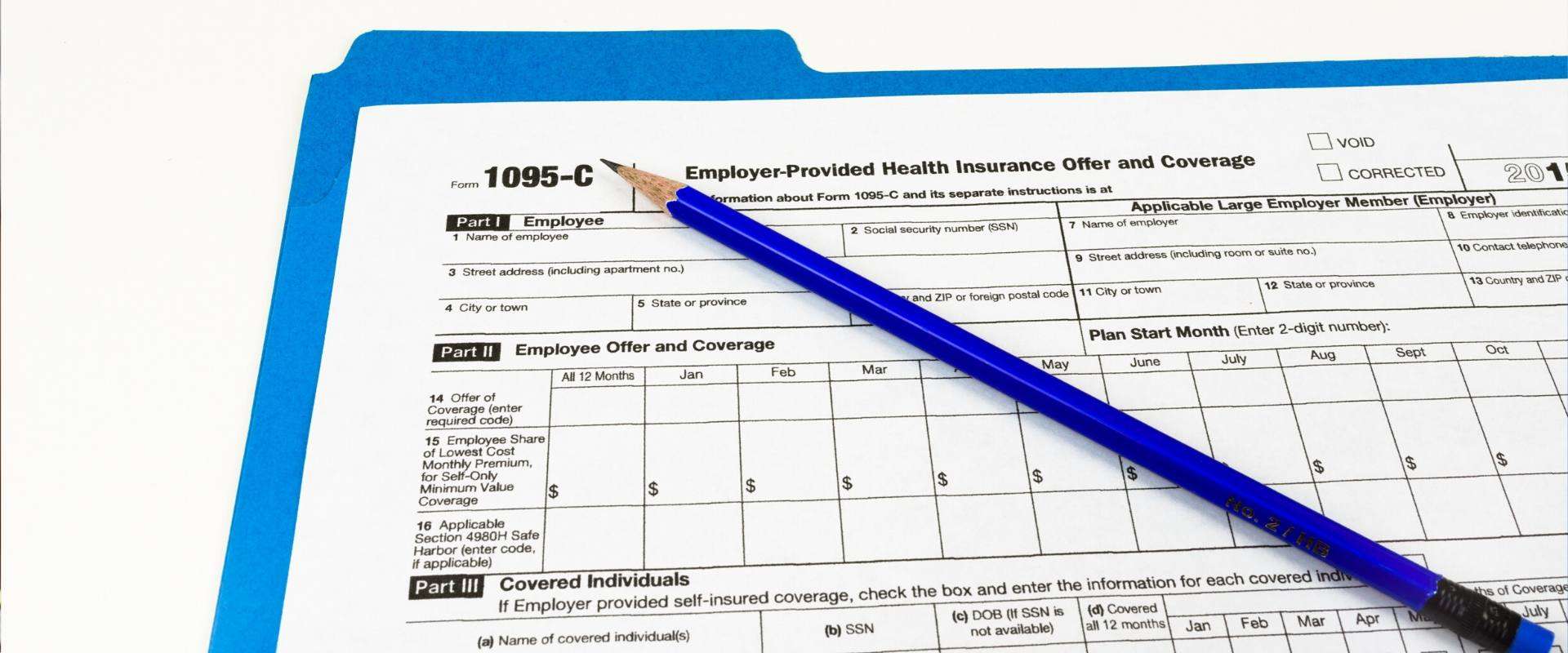

*Updated for tax year 16 In January, aside from receiving your usual Form W2 from your employer, you may receive Form 1095C related to the Affordable Care Act (ACA) If you received health insurance outside of the marketplace exchanges in 16, and worked for a large employer, look for Form 1095C, EmployerProvided Health Insurance Offer and Coverage, to arrive in yourForm 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax credit · form 1095c codes 18 Form 1095B and Form 1095C to Individuals Extended !

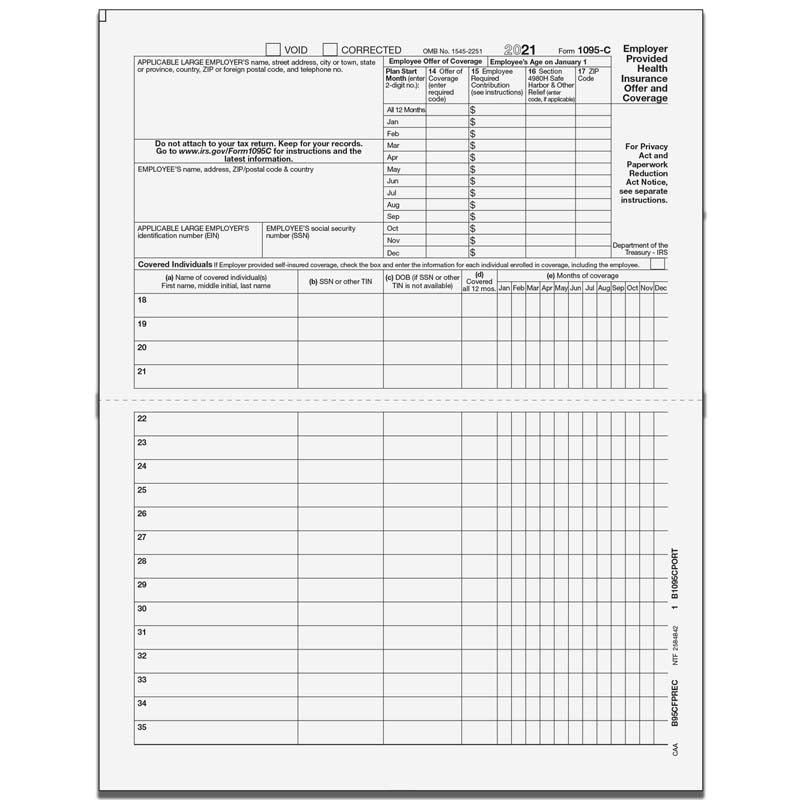

December 6, 18 by Prashant Thakur The Internal Revenue Service has extended the due date for furnishing the 18 Form 1095B and Form 1095C to individuals from January 31, 19 to March 4, 19This extension is automatic which means that you do not need to submit a request · The Form 1095C is an IRS form created when the Affordable Care Act (ACA) was implemented, and that must be distributed to all employees describing their health insurance cost, opportunities, and enrollment · On July 13, the IRS released the draft iteration of the Form 1095C At first glance, it appears there have been significant changes to the Form 1095C However, in reality, most employers will complete the Form 1095C exactly the way they did in previous years The remainder of this article briefly discusses the changes made in the draft Form

1095 C Faqs Mass Gov

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Emergency tax codes are temporary Your employer can help you update your tax code Previous Check if your tax code is correct; · Form 1095C may be sent electronically like the W2 if the IRS electronic distribution requirements are met, but the employer must receive consent from the employee separate from the W2 All of the 1095C forms must be submitted with the 1094C If you are filing over 250 1095C forms, you are required to file electronically February 28th, 16Basically, Form 1095 C is used by employers to report the health benefits that they provide their employees A copy of the form should be furnished to the employees as well If you are an employer filing 1095 C, you should be aware of codes to enter on lines 14, 15, and 16 These three lines are a crucial part of the form

What S New For Tax Year Aca Reporting Air

Form 1095 C Forms Human Resources Vanderbilt University

Your tax code will normally start with a number and end with a letter 1257L is the tax code currently used for most people who have one job or pension · 18 1095C Codes For more information Section 4980H affordability Form W2 safe harbor Enter code 2F if the ALE Member used the section 4980H Form W2 safe harbor to determine affordability for purposes of section 4980H(b) for this employee for the year If an ALE Member uses this safe harbor for an employee, it must be used for all months of the calendarLine 14 of IRS Form 1095C lists a code that describes whether an employee was offered coverage by their employer, the type of the coverage offered,

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Your 1095 C Tax Form For Human Resources

The IRS has issued Form 1095C, EmployerProvided Health Insurance Offer and Coverage, for ALEs to satisfy the reporting requirement under Code § 6056 If the employer selffunds its plan (s), the employer also will use Form 1095C to satisfy the additional requirement under Code § 6055 · How can it be that no information is needed from 1095C when according to the IRS Part II contains information regarding premium tax credit eligibility?1095C, EmployerProvided Health Insurance Offer and Coverage, is an IRS form used by Applicable Large Employers (ALEs) to report information about employee's health coverage Businesses with 50 or more fulltime employees are termed as ALEs Form 1095 C should be filed with the IRS, and copies should be furnished to employees

Instructions For Forms 1095 C Taxbandits Youtube

Aca Reporting Faq

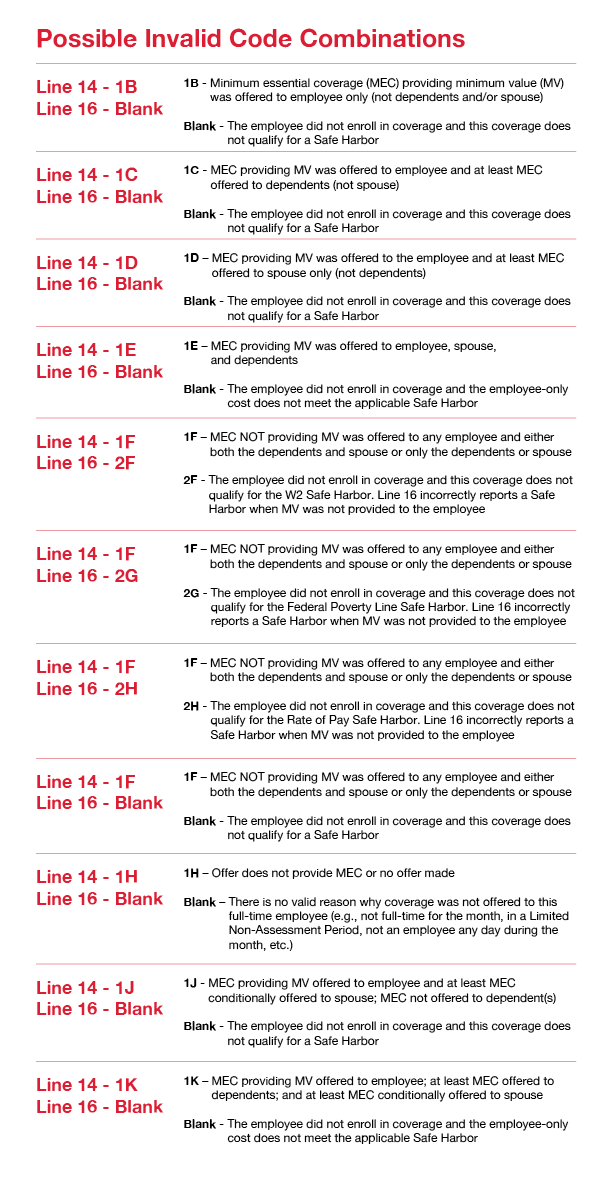

Form 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn moreThe IRS Form 1095C, also known as the EmployerProvided Health Insurance Offer and Coverage statement, contains important information about medical coverage offered to employees and their dependents by Clemson University While this information is no longer required when filing one's taxes, it should be retained with the employee's personal records A Form 1095C will beACA FORM 1095C CODE SERIES The IRS has designed two sets of ACA codes to provide employers with a way to describe health coverage offers on Form 1095C Each code indicates a different scenario regarding an offer of coverage, Section 4980H Safe Harbor Codes and other relief for ALE Members The following topics will be more specific about the codes to be reported on line 14 & 16 of Form

1094 C 1095 C Software 599 1095 C Software

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

· Code 1A alert On January 26, 16, the IRS revised ACA reporting guidance on how employers document a qualifying offer of health coverage on Form 1095CThe Form 1095C contains important information about the healthcare coverage offered or provided to you by your employer Information from the form may be referenced when filing your tax return and/or to help determine your eligibility for a premium tax credit Think of the form as your "proof of insurance" for the IRS If you or a family member enrolled in healthcare coverage/10/ · Every ALE needs to provide a Form 1095C with Lines 1416 completed with the correct information Here is a breakdown of each line and what the corresponding codes mean Line 14 – Offer of Coverage Line 14 specifies the type of coverage, if any, offered to an employee, spouse, and dependents

What Your Clients Need To Know About Form 1095 C Accountingweb

Irs Form 1095 C Codes Explained Integrity Data

· On Line 14 of Form 1095C, employers are prompted to enter a code that describes the type of health coverage offered to a particular employee during the tax year See below for a breakdown of the different codes that your organization can use to populate on Line 14 · Employers offering ICHRAs that intend to furnish Form 1095B instead of 1095C must enter a new Code "G" on Form 1095B, Line 8 to identify the coverage as an ICHRA ZIP Code Employers sponsoring ICHRAs must also disclose an employee's Zip Code on Form 1095C if the employer uses the employee's location to determine affordabilityJohn Barlament walks through how to fill out IRS forms 1094C and 1095C This presentation was given to selffunded employers at an Alliance Learning Circle

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Irs Form 1095 C Uva Hr

· Form 1095C, also referred to as the EmployerProvided Health Insurance Offer and Coverage, is an IRS tax form used to report to the IRS any information regarding an employee's health coverage offered by an Applicable Large Employer (ALE)IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement The Section 6056 reporting requirement relates to the employer shared responsibility/play or pay requirement Information from Form 1095C will also be used in determining whether an individual is eligible for a premium tax credit Line 14 of the 1095C is where an employer reports an offerForm 1095 Code Definitions Lines 14, 15, and 16 Line 14 Offer of coverage code 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for selfonly coverage equal to or less than 95% mainland single federal poverty line and at least minimum essential coverage offered to spouse and dependent(s) 1B

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

1095 C Employer Provided Health Insurance Offer Of Coverage

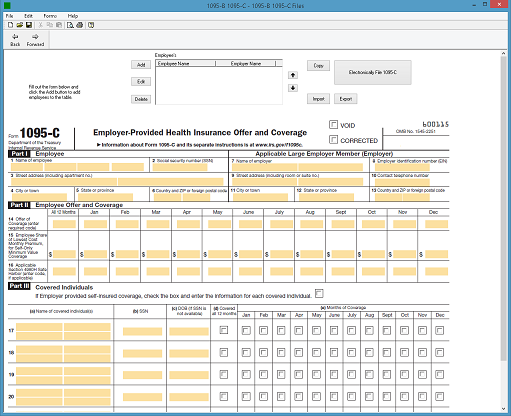

· The Form Below is Form 1095C from the IRS website This guide will explain each piece of the form and help you determine the proper codes for the fields in Part II Shown below in blue, Parts I and III are comprised of lines 113 and 1734, respectively These sections are easy enough, just employee information Part II Shown below in orange, Part II is made up of lines 15GUIDANCE FOR COMPLETING FORM 1095C AND FORM 1094C FOR WHICH EMPLOYEES MUST A MIIA TRUST MEMBER COMPLETE FORM 1095C? · 1095C forms are filed by large employers If they are selffunded, they just fill out all sections of 1095C If they are fully insured, they get a 1095B from the insurer and fill out Sections I and II of 1095C Employers who have to file the forms will also need to file a 1094B or 1094C forms for Applicable Large Employer (ALE) requirements and to tell the IRS if you offered

Aca Code Cheatsheet

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

· There are specific changes to the Form 1095C to reflect the reporting of ICHRAs First, there is an entirely new line that captures the employee's zip code, Line 17 This line indicates the zip code of the employee This will be used to determine affordabilityForm 1095C Line 16 Codes are used to report information about the type of coverage an employee is enrolled in and if the employer has met the employer's shared responsibility "Safe Harbor" provisions of Section 4980H The table below explains the code series 2 · When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16

Irs Form 1095 C Codes Explained Integrity Data

Irs Distribution Deadline March 2 21 Aca Gps

Next We'll send you a link to a feedback form It will takeIRS Form 1095C Indicator Codes for Lines 14, 15, and 16 Form 1095C, Part II, Line 14 Indicator Code Series 1 for "Offer of Coverage" 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for self only coverage equal to or less than 95% mainland single federal poverty line and at least minimum essentialSeems like that would be pretty significant to a persons tax return and refund or amount owed Can you clear this up for me?

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

Form 1095 C Guide For Employees Contact Us

· Eleven IRS Form 1095C Code Combinations That Could Mean Potential Penalties May 14, 19 The 1095C form is used by employers with 50 or more fulltime and fulltime equivalent employees (also referred to as applicable large employers or ALEs) to report information required under Section 6056 of the Affordable Care Act This includes their offers of healthAdministrator, the IRS may not be able to match the Form 1095C to determine that you and the other covered individuals have complied with the individual shared responsibility provision For covered individuals other than the employee listed in Part I, a Taxpayer Identification Number (TIN) may be provided instead of an SSN See Part III Part I Applicable Large Employer MemberIRS Form 1095C Part II Code Combinations wwwunifyhrcom Calculating the 1095C Lines 1416 codes are one of the more daunting tasks of ACA reporting For tax reporting, many employers find themselves relying on their "best guesses" or their vendor partners to correctly determine their 1095C Part II codes Some even simply mark all fulltime employees 1A in Line

The New 1095 C Codes For Explained

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

· Generally, the IRS needs to know whether the ALE offered minimum essential coverage to at least 95% of its fulltime employees and whether the offered coverage provided minimum value and was affordable for purposes of Code § 4980H Form 1094C is a transmittal to the IRS that, in combination with Form 1095C providing individualized

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Aca 1095 C Code Cheatsheet

Ez1095 Software How To Print Form 1095 C And 1094 C

Irs Form 1095 C To Be Distributed Hub

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Irs Announces Additional Ichra Codes For Form 1095 C

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

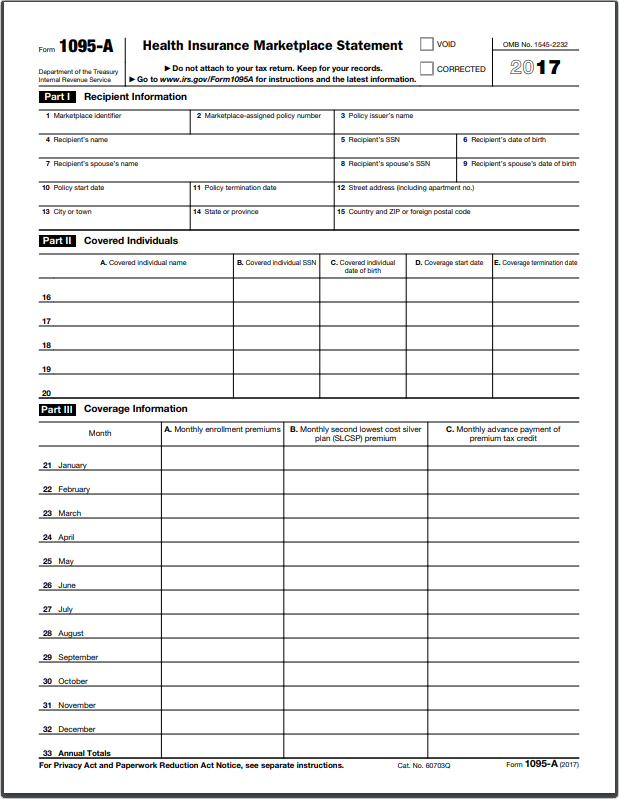

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Irs Form 1095 C Codes Explained Integrity Data

Code Series 2 For Form 1095 C Line 16

Alert Irs Extends Due Date For Forms 1095 C And 1095 B

Obamacare Tax Forms 1095 B And 1095 C 101 Moneytips

Obamacare Tax Forms 1095 B And 1095 C 101 Moneytips

Irs Form 1095 C Fauquier County Va

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

Ez1095 Software How To Correct 1095 C And 1094 C Form

Form 1095 C Payroll Baylor University

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Irs Form 1095 C Codes Explained Integrity Data

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Irs Form 1095 C Codes Explained Integrity Data

16 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Changes Coming For 1095 C Form Tango Health Tango Health

trix Irs Forms 1095 C

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

State Individual Mandates Add To Employer Reporting Responsibilities Foster Foster

Annual Health Care Coverage Statements

Benefits 1095 C

Section 6056 Large Employer Reporting Ts1099 Ts1099

Sample 1095 C Forms Aca Track Support

Irs Form 1095 C Codes Explained Integrity Data

Free 1095 C Resource Employee Faqs Yarber Creative

Toast Payroll Common Combinations Form 1095 C Codes

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

1095 C Form Printable Fill Online Printable Fillable Blank Pdffiller

Fillable 1095c Fill Online Printable Fillable Blank Pdffiller

The Codes On Form 1095 C Explained The Aca Times

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Aca Code Cheatsheet

Accurate 1095 C Forms Reporting A Primer Integrity Data

What Do 1095 Forms Mean To Your Business

Irs 19 Form 1095 C Now Online Stuttgartcitizen Com

Tax Form 1095 C Employer Provided Health Insurance 1095c Form Center

Tax Form Preparation Software 1095 C Software To Create Print And E File Forms 1094 C 1095 C

What Is The Irs 1095 C Form Miami University

1095 C Forms Employeeemployer Copy 50pk Office Depot

Aca 1095 C Basic Concepts

1095 C Form Official Irs Version Discount Tax Forms

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Code Series 1 For Form 1095 C Line 14

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Your 1095 C Tax Form My Com

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

The Aca S 1095 C Codes For The Tax Year What Employers Need To Know About The Aca 1095 C Codes

What Is An Irs Form 1095 C Boomtax

Aca Code Cheatsheet

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Aca Code Cheatsheet

Standard Register Laser Tax Forms 1095c Irs Copy 50 Sheets Per Pack Sr Direct

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Form 1095 A 1095 B 1095 C And Instructions

Hr Updates Theu

1095 C Preprinted Portrait Version With Instructions On Back

1094 C 1095 C Software 599 1095 C Software

New 1095 C Codes Will Apply To The Tax Year Aca The New 1095 C Codes For Explained

Ez1095 Software How To Correct 1095 C And 1094 C Form

Form 1095 C Released New Codes New Deadlines

0 件のコメント:

コメントを投稿